Table of Contents

- Introduction - Simplify your eCommerce accounting with Open Payout

- (Video) Learn Open Payout

- Confidentiality and Your Data Security

- FAQ

-

- Getting Started With Xero

- Getting Started With QuickBooks

- Getting Started With FreshBooks

- Connecting Your First Store

- Connecting a Client's Store

-

- Data Flow

- Screenshots

-

- Grouping Sales and Taxes by Country

- Adding Transaction Fees

- Defining the Tax Year

- Creating Month End Payouts

- Three Kinds of Payout

- Understanding Etsy Balance Carried Forward and Balance Brought Down

- Etsy Recoups

-

- About Us

- Contact Us

We pride ourselves on first class user support, please message us on our chat if you have any questions

Defining the Tax Year

Open Payout helps you reconcile payments that you receive. It does this by creating Journal Entries in QuickBooks and Invoices in Xero that match with real money payments from your shop's payment gateways.

But in most tax jurisdictions, you need to declare your income when you make it rather than when you receive payment for it.

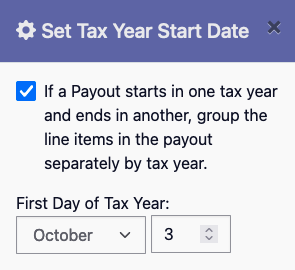

If you're generating payouts on a weekly schedule, getting paid in disbursements or your countries tax year doesn't end exactly on the first of a month then you may need to split payouts that overlap multiple tax years so that you can see which sales occurred in which year.

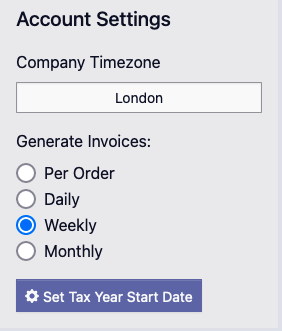

Open Payout can do this automatically for you. Simply set your tax year start date from the account settings menu:

Open Payout will then automatically split your payouts at the end of the Tax Year